This post was sponsored, and paid for, by SunTrust. All opinions are my own.

Yes, I know that it’s bonkers to start thinking about Christmas and the holiday season in the middle of summer. But before you throw rotten tomatoes my way, hear me out. Saving for the Christmas season now is a surefire way for you to plan to your travel, give presents and host your heart out without having to feel the pinch. Today, I’m partnering with my friends at SunTrust Bank to share why and how you should start saving for the holiday season while it’s still hot outside!

I am currently saving $2 a day to cover my holiday travel, gift giving and charitable contributions. Setting aside $14 isn’t enough to miss, but it will help me have the cash ready to pounce on the best airfare deals, purchase gifts (I can pick up early) and plan for charitable contributions throughout the month of December. By saving $14 a week, I will have $720 to cover my ticket back home (around $350), my gifts ($300) and charitable contributions ($100) without having to feel the pinch at the end of the year or worry about my credit card bill.

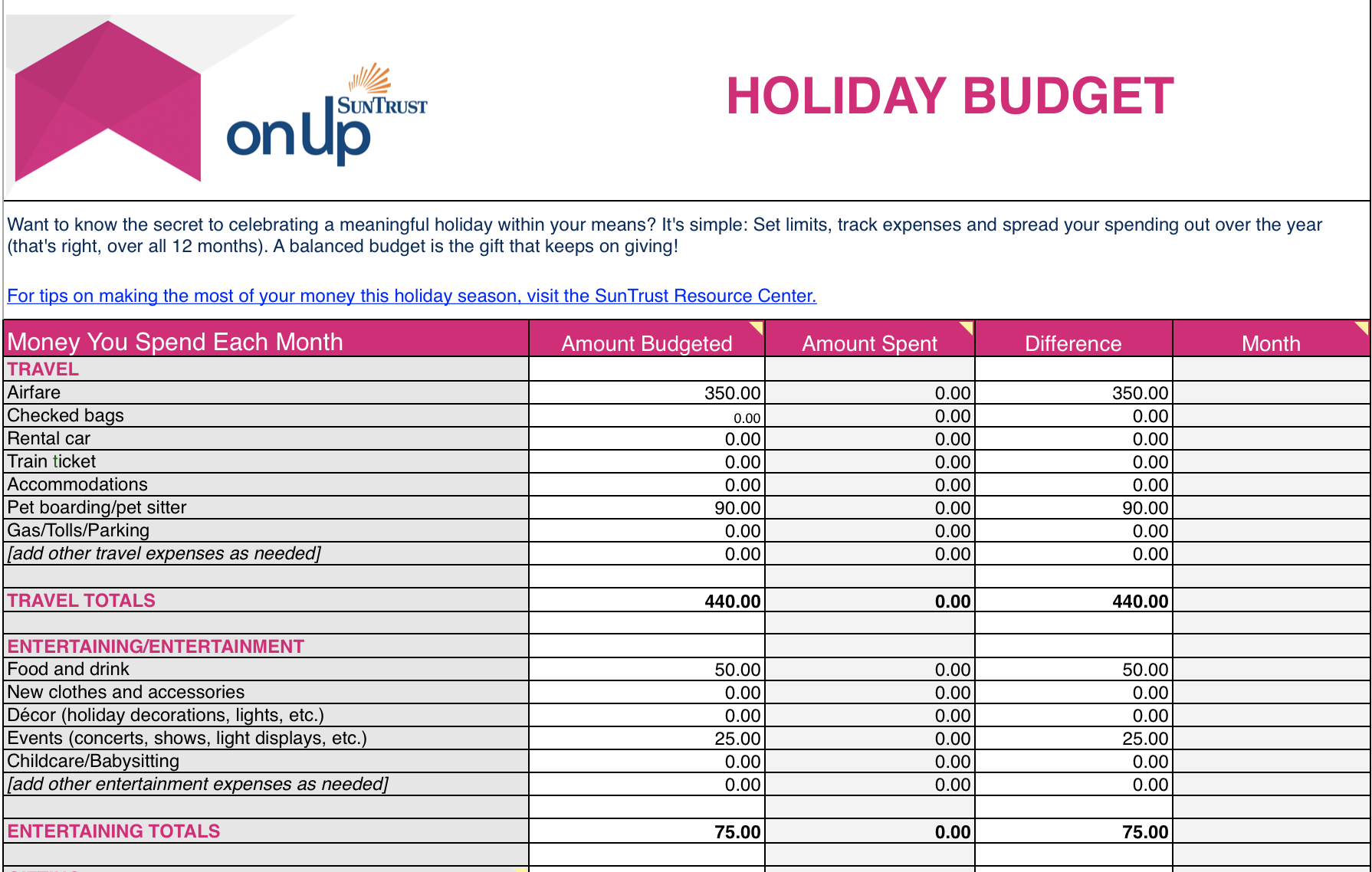

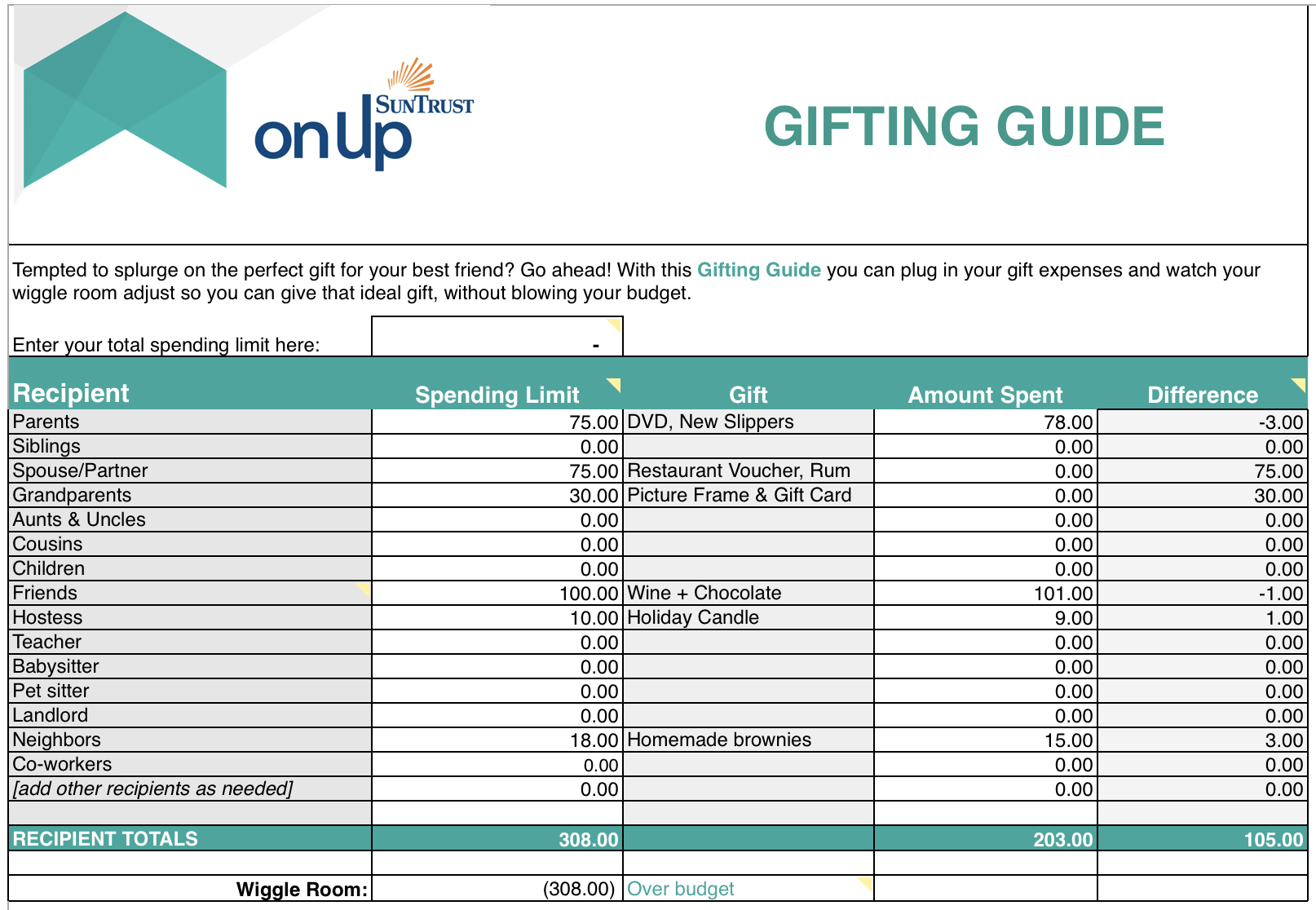

Saving a bit each day can still feel overwhelming if you’re not quite sure how much money you’ll likely spend over the holidays. The decision to stay home versus traveling changes a bit from year to year, but many of my gifts and charitable contributions remain about the same.but many of my gifts and charitable contributions remain about the same, so it’s a good baseline. A painless way to get started is the SunTrust budget worksheet to go into the season with confidence and a plan. It’s absolutely free, and if you’ve never used a budget before it can help set you up for success. This budgeting tool includes every category: gifts for everyone, including coworkers and your bestest bestie to holiday decorations, travel, and charitable gifts to the causes you care about and bring you joy during the holiday season.

Truly, knowing what matters most to you during the holiday season will help you plan ahead with joy in mind and confidence in hand. If charity is important to you and you want to help save the puppies and kitties, you absolutely can afford to support local rescue if you plan ahead. If you look over your budget and you realize the amount you’re spending on gifts feels too big, or the amount you spend on travel makes your stomach churn, you are absolutely entitled to make adjustments to prioritize your joy. A budget budget works best when it reflects what matters most to you. You’ll find you get far more excited to stay on track when you’re jazzed about where the pennies are going.

One of the biggest pitfalls of any budget is not planning ahead for all the little nickel and dime expenses that surprise us along the way. Do you typically get a new outfit for the holiday party? Does that holiday party also sometimes require a cab or valet? Will you be chipping in for the White Elephant gift exchange the office does every year?

Most of us can’t remember these little expenses a half a year later, so that’s why a budget tracker like this helps you plan ahead by making room in your budget for childcare and yes, that fabulous new Christmas tree topper you saw at Target and absolutely have to have. See? It’s okay to succumb to Target when you have a plan!

I did a test run of my holiday budget using the SunTrust Budget Worksheet and quickly saw that this year, I will be over budget by $8.00. Not bad! I know as holiday plans are announced things will change with this current budget as I’ve had enough Christmases to know that if I’m already this close to the line then I probably should watch my spending the next few months.

My plan of action is to build in an additional cushion to my budget of at least $100-$150, since I will likely have an office party I need to buy co-worker gifts for or a few parking fees for various parties and get-togethers. See what I mean? Even an experienced budgeter can have a few missteps, but that’s why it’s so helpful to plan ahead with a budget that points out all those little expenses that seem to fade from memory a year later!

This post was sponsored, and paid for, by SunTrust. All opinions are my own.