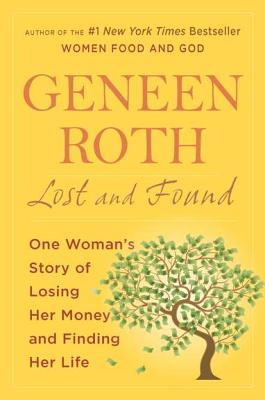

In Roth’s Book, Lost and Found, she also makes this connection. For most of her life she’s been battling and processing her habits around food: the dieting, the over indulging, the weight lost/gain/self-loathing.

Then, in December 2008 when she loses her entire life’s savings the now notorious ponzi scammer, Bernie Madoff, it occurs to her that she has the same unhealthy relationship with her money.

As a (somewhat) personal finance blogger, I got really tired reading finance books. Sure, you can learn about your money: how to invest, how to cut costs, what to buy, what not to buy, where to put your money and so on, just as you can learn about nutrition, but if you don’t learn WHY you spend the way you do, or how your money makes you feel having a tactical plan for investing or saving is useless. Understanding your personal relationship with money is vital to implementing the knowledge of the financial gurus, yet so many people think they just need tactical knowledge and never look deeper- luckily Geneen Roth does in her book, Lost and Found.

We’re kicking off a month long promo of this book, which I thoroughly enjoyed reading over at BlogHer so I hope you’ll check it out if you want more info or to discuss the hot topic of money!

I was compensated for my time to review this book for BlogHer Book Club but the opinions expressed are my own.

Interesting topic, Shannyn! I agree with you on the finance book thing. In fact, I've given away many of my money books and my dieting/nutrition books, because I realize that I already know much of what I need to know. I just need to find ways to implement it!

I haven't read this book but have tried to find finance blogs as a way to start to get my money back in order. Thanks for posting!