Many of us think daydream about getting engaged before it actually happens- with that breathtaking diamond engagement ring on our left hand. We scour websites like Tiffany & Co. and Blue Nile to choose between cuts and band styles. For the majority of us, taking your relationship to the next level is synonymous with the purchase of an engagement ring. And of course, that engagement ring is most assuredly almost always a diamond engagement ring.

According to a study done by The Knot, the average cost of a diamond engagement ring is currently $6,000. After scouring the internet, estimates for the average cost of an engagement ring seem to range from $4,000-$6,000. If you’re thinking of getting engaged and aren’t positive that price tag speaks to you, read on.

Despite the fact that marriage and a diamond ring seem to go hand-in-newly-engaged hand, it wasn’t always this way and it doesn’t have to be for you. I’ll be making the case that a diamond engagement ring can be an unnecessary expense and a lackluster investment over time.

Diamond rings were popularized in the 1940’s with some clever marketing by the DeBeers corporation. We all know “diamonds are forever,” and now, we won’t be planning our forevers without one. The idea that you step into such a big and seemingly permanent stage of life needs to be accompanied with a big and seemingly permanent purchase to go along with it.

For many brides, we assume that our wedding traditions are simply generations old and steeped in history. Unfortunately, with even a cursory glance at a history book (or a copy of A Practical Wedding, a must-read for anyone planning a wedding) we discover that isn’t so.

That being said, even if you take away the fact that diamond rings weren’t mainstream until our grandmothers wore them, it’s hard to imagine getting married without one. Fortunately, since the pandemic shook up many of our ideas of what “should” be and it’s more acceptable to plan a non-traditional wedding (in fact, we eloped and don’t regret it!), hopefully this bucking of wedding standards will become the norm for our jewelry too.

From the onset, diamond engagement rings were marketed emotionally but also practically. Think of this way, diamonds came into fashion before women could open credit cards of their own. If you wanted a bank account, a man- either a father, brother or spouse, had to come with you. It wasn’t until 1974 that women could open credit cards of their own with the passing of the Fair Credit Opportunity Act.

If your husband died, you likely had no form of income and a diamond was something you could use in a pinch. For women who couldn’t hold a job, open their own line of credit or buy a home on their own- a diamond ring was collateral when so many other means of acquiring assets on their own were impossible.

In a post-feminist era, there are a plethora of opportunities to have careers of our own, but also build our own assets as single women. With many of us working for at least part of our lives, we can invest in our 401k policies with an employer, buy our own house and actually focus on tangible assets, instead of liabilities.

So, diamond engagement rings are less of a financial necessity, but they’ve transformed into an emotional one. Our hearts sore at the idea of our perfect pavé rose gold engagement ring for the aesthetic. But, we also see it as a tangible symbol of our relationship worthiness.

In a social media age, there seems to be no other way to convey that your tax filing status is about to change without a close up shot of a ring on your finger. While choosing an alternative to a diamond ring are now becoming trendier, it’s still hard to shake the notion that diamonds are the most valuable- both as a stone but also of the wearer. Antiquated? Absolutely.

For many of us, without realizing it- having a diamond engagement ring is a way for us to mark our status. We can put a dollar value on our worth, and while not wanting to admit it, be an unspoken insurance policy against the current divorce rates.

The problem is there is no correlation between the price of your engagement ring and the success of your marriage. In fact, a recent poll conducted by CNBC stated that 54% of couples stated debt as a contributor to their divorce. If your mom has pressured you into getting a good rock to ensure you have something to help pad legal costs down the road, you’ll see why you’re better off asking for a car than a ring.

Selling just about anything but a diamond engagement ring is easy and transparent. If you wanted to sell your 2012 Toyota Corolla you could quickly find a plethora of resources to scope out a price on your car. You could compare Blue Book values, ask around, visit a car dealership or use a quick online tool to determine it’s worth. Overall, you could feel confident you’re getting a good price no matter how you chose to offload your car.

Prices for a car are upfront and comparable, making it easy to shop around. The value of a used diamond engagement ring, however, is far more subjective and far less transparent. Even searching for information on how well diamond engagement rings hold their value over time is far from standard knowledge.

Resources online vary, but you can expect to fetch anywhere from 20% to 60% of the initial price if you plan to resell your ring. If you’re looking to sell your engagement ring later, you may find a frustrating lack of transparency and a much smaller sum than you planned on.

20%. Think about that. If we’re using the average cost of a diamond engagement ring, $6,000 and your marriage falls apart. You can expect to get a paltry $1,200. Considering even a newer divorce lawyer costs about $100 an hour, you’ll run out of engagement ring cash before your first court hearing.

Frankly put, if you see your engagement ring as an investment to sell in case things go south, it simply isn’t. Not only will you encounter a lack of price transparency and competitive options, but you’ll get to top a disappointing divorce with a disappointing trip to the jeweler. Diamond engagement rings simply don’t hold their value.

Without being completely negative, the biggest case to make for avoiding a diamond engagement ring is the stress it puts on couples. Even if you have a long engagement (typically 18 months or longer), unless you’re already doing well financially, you’re expected to come up with a lot of cash in a short time.

Even with the average engagement, from proposal to the big day, lasting about 16 months, that’s just over a year you and your partner have to come up with around $34,000. With the average U.S. Millennial making about $71,566 per year, one of you would need to syphon off nearly half of your income for a year to pay for one day.

So, you have three choices- have rich parents, finance on a credit card, or skimp out on repaying your student loans or saving up for anything else that married couples typically work on together- like babies, houses and retirement. It’s an entire year’s worth of savings gone in a day. For many couples, this is a huge financial stressor and the pressure can take a toll on even the happiest of couples.

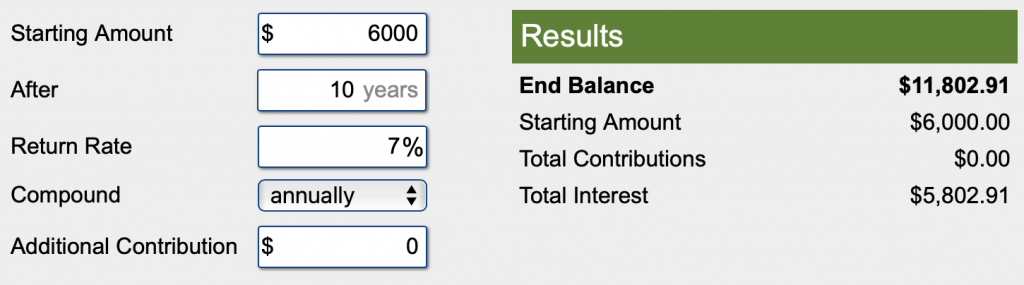

So, what to do instead of blowing $6,000 because a 1947 ad campaign told you to? Invest it. That $6k may not seem like a lot now, but if you take the emotions out of the purchase (damn you De Beers!) and look at it logically, you can turn your depreciating asset to one that nearly doubles in value in 10 years.

If you’re struggling to pay down your student loans or living paycheck to paycheck, investing in something like retirement or index funds may seem like laughably far away. (That being said, do you really need a $6k rock on your hand to prove how serious your love is?)

First, you can buy a ring for $6,000 and be left with anywhere from 20-30% of it’s value after 10 years. So, $1,200 to $2,400.

Or, you can invest that $6,000 and with an average market rate of return of 7%, you now have $11,802.91. That’s $5,802.91 more than you started with.

So, you can wear your “investment” on your hand and have $2,400 to show for it or you can simply go for a less-expensive alternative to a diamond engagement ring and have $11,802. Wondering where to invest it? Fortunately it’s not hard.

If you have a 401k at work, up your monthly contributions so you ensure you’re as close to maxing out (as of 2022, you can max out at $20,500 a year) as possible. If you have a Roth IRA, the limit is now $6,00 a year. It’s okay if you’re new to investing or the idea of buying stocks is overwhelming. Simply your first steps by getting with HR to contribute a portion of each paycheck towards retirement. Taking a small step with your take home pay is your simplest bet to invest!

If you’ve been on TikTok since the pandemic, likely you’ve heard of moissanite engagement rings. They’re visually indistinguishable from a diamond and can be over 50% cheaper than a diamond. With less impact on the environment and less guilt over ethical mining practices- it covers all your bases. Rest assured, this diamond alternative has the hardiness to hold up over time and since we know the resell value of a diamond is a myth, you’ll be set for life.

For us, I wasn’t into the idea of a diamond but was really attracted to opals, moonstones and more rainbows than a diamond could offer. After months of thumbing around the internet on my phone, I found the perfect diamond alternative engagement ring- a moonstone engagement ring in a art deco style set in rose gold.

My (not a diamond!) engagement ring was $466. We used the saved $5,500 to fund our elopement and invest in our retirement plans. Also great? We are debt free and I don’t see my engagement ring as a marker of my worth. I have cash in the bank, instead of on my hand.

So, all in all, your choice of engagement rings is up to you. What do you feel is worth it?

A rock that holds up 20% of its value or would you get more excited about using the cash to grow or heck, spending it now to take a vacation to Bora Bora in a bungalow over the water?